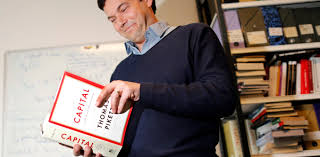

The best-selling book from Thomas Piketty Capital in the Twenty-first Century won the Financial Times Business Book of the Year Award in 2014.

What are the grand dynamics that drive the accumulation and distribution of capital? Questions about the long-term evolution of inequality, the concentration of wealth, and the prospects for economic growth lie at the heart of political economy. But satisfactory answers have been hard to find for lack of adequate data and clear guiding theories. In Thomas Piketty Capital in the Twenty-first Century, the author analyses a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Capital in the Twenty-First Century shows that modern economic growth and the diffusion of knowledge have allowed us to avoid inequalities on the apocalyptic scale predicted by Karl Marx. But we have not modified the deep structures of capital and inequality as much as we thought in the optimistic decades following World War II. The main driver of inequality–the tendency of returns on capital to exceed the rate of economic growth–today threatens to generate extreme inequalities that stir discontent and undermine democratic values. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, Piketty says, and may do so again.

A work of extraordinary ambition, originality, and rigour, Thomas Piketty Capital in the Twenty-first Century reorients our understanding of economic history and confronts us with sobering lessons for today.

It seems safe to say that the magnum opus of the French economist Thomas Piketty Capital in the Twenty-first Century will be the most important economics book of the year—and maybe of the decade. Piketty, arguably the world’s leading expert on income and wealth inequality, does more than document the growing concentration of income in the hands of a small economic elite. He also makes a powerful case that we’re on the way back to ‘patrimonial capitalism,’ in which the commanding heights of the economy are dominated not just by wealth, but also by inherited wealth, in which birth matters more than effort and talent. (Paul Krugman New York Times 2014-03-23)

A sweeping account of rising inequality… Eventually, Piketty says, we could see the reemergence of a world familiar to nineteenth-century Europeans; he cites the novels of Austen and Balzac. In this ‘patrimonial society,’ a small group of wealthy rentiers lives lavishly on the fruits of its inherited wealth, and the rest struggle to keep up… The proper role of public intellectuals is to question accepted dogmas, conceive of new methods of analysis, and expand the terms of public debate. Thomas Piketty Capital in the Twenty-first Century does all these things… Piketty has written a book that nobody interested in a defining issue of our era can afford to ignore. (John Cassidy New Yorker 2014-03-31)

A sweeping account of rising inequality… Eventually, Piketty says, we could see the reemergence of a world familiar to nineteenth-century Europeans; he cites the novels of Austen and Balzac. In this ‘patrimonial society,’ a small group of wealthy rentiers lives lavishly on the fruits of its inherited wealth, and the rest struggle to keep up… The proper role of public intellectuals is to question accepted dogmas, conceive of new methods of analysis, and expand the terms of public debate. Thomas Piketty Capital in the Twenty-first Century does all these things… Piketty has written a book that nobody interested in a defining issue of our era can afford to ignore. (John Cassidy New Yorker 2014-03-31)

That capitalism is unfair had been said before. But the best-selling book from Thomas Piketty Capital in the Twenty-first Century says it subtly and with a relentless logic that has sent economics into a frenzy.

If you get slow growth alongside better financial returns, then inherited wealth will, on average, “dominate wealth amassed from a lifetime’s labour by a wide margin“, says Piketty. Wealth will concentrate to levels incompatible with democracy, let alone social justice. Capitalism, in short, automatically creates levels of inequality that are unsustainable.

Simon Kuznets, the Belarussian émigré who became a major figure in American economics, used the available data to show that, while societies are less just and equal in the first stages of industrialisation, inequality subsides as they achieve maturity. This “Kuznets Curve” had been accepted by most economics until the bestseller from Thomas Piketty Capital in the Twenty-first Century produced the evidence that in fact, the curve goes in exactly the opposite direction. Capitalism started out unequal, flattened inequality for much of the 20th century, but is now headed back towards Dickensian levels of inequality worldwide.

Piketty’s call for a “confiscatory” global tax on inherited wealth makes other supposedly radical economists look positively house-trained. He calls for an 80% tax on incomes above $500,000 a year in the US, assuring his readers there would be neither a flight of top execs to Canada nor a slowdown in growth since the outcome would simply be to suppress such incomes.

Piketty is not the new Karl Marx, since Piketty’s world is of concrete historical data only. Piketty has placed an unexploded bomb within mainstream, classical economics.

Piketty’s Capital, unlike Marx’s Capital, contains solutions possible on the terrain of capitalism itself: the 15% tax on capital, the 80% tax on high incomes, enforced transparency for all bank transactions, overt use of inflation to redistribute wealth downwards. He calls some of them “utopian” and he is right. It is easier to imagine capitalism collapsing than the elite consenting to them.

| Title | Capital in the Twenty-First Century |

| Author | Thomas Piketty, Arthur Goldhammer |

| First published | August 2013 |

| Publisher | Belknap Press |

| ISBN | ISBN 067443000X |

| Language | English |

| Literary Awards | Financial Times and McKinsey Business Book of the Year (2014), Arthur Ross Book Award (2015), Kirkus Prize Nominee for Nonfiction (Finalist) (2014), Goodreads Choice Award Nominee for Business Books (2014), Waterstones Book of the Year Nominee (2014) British Academy Medal (2014) |