The Advanced Diploma in Insurance of the Chartered Insurance Institute CII is a professional qualification providing an enhanced understanding of insurance practice, both technical subject matter and overall application skills.

The Advanced Diploma in Insurance of the Chartered Insurance Institute CII is a professional qualification providing an enhanced understanding of insurance practice, both technical subject matter and overall application skills.

The Advanced Diploma is a comprehensive assessment of market knowledge and understanding. In becoming Advanced Diploma qualified, you join the community of proven insurance professionals. It is evidence of your purpose, commitment and ability.

It can be your passport to a successful and fulfilling career.

Upon completion, you will be entitled to use the designation ‘ACII’ (CII membership and Continuing Professional Development requirements apply).

The Advanced Diploma in Insurance is appropriate for:

- Today’s insurance managers and technical specialists;

- Staff with aspirations to become managers in the future;

- Those employees who wish to demonstrate their professional standing;

- Insurance employees without another professional qualification and those who wish to build upon existing general academic qualifications, such as a degree, by obtaining an industry-specific qualification.

Entry requirements

None, however, it is recommended that candidates hold the Diploma in insurance or 3 A-levels or equivalent.

Completion requirements

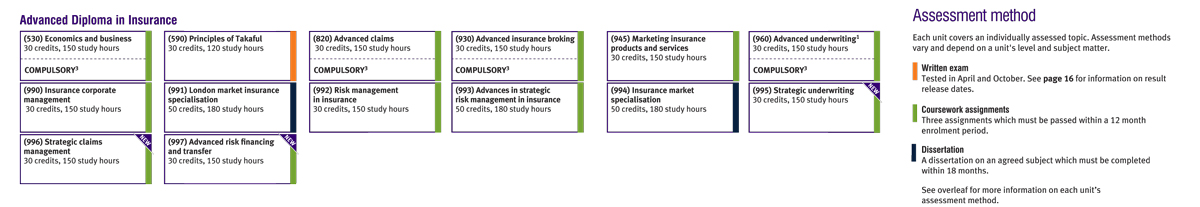

To complete the Advanced Diploma you must obtain a minimum of 290 CII credits, with at least 205 CII credits at Diploma level or above, including at least 150 CII credits at Advanced Diploma level.

There are further compulsory unit requirements, please see details under the completion requirements section on the Key facts page.

Unit study materials for this qualification typically include:

- Study text with updates or coursework assessment and study text

- RevisionMate online study support

- Revision courses.

From the Advanced Diploma you can apply for Chartered status (subject to having five years’ experience, not necessarily post-qualification), with the CII’s four Chartered insurance titles reflecting your career specialism:

- Chartered Insurer;

- Chartered Insurance Broker;

- Chartered Insurance Practitioner; and

- Chartered Insurance Risk Manager

Chartered status cements your professional standing and gives you parity with other professionals such as accountants and solicitors. The CII also offers corporate Chartered status to qualifying firms of insurance brokers, further enhancing the visible professionalism of the broker sector. Visit the Chartered section of our website for full details.