The Diploma in Insurance of the Chartered Insurance Institute (CII) is a technical and supervisory qualification for insurance staff working across all sectors of the industry, and the logical progression from the CII Certificate in Insurance.

The Diploma in Insurance of the Chartered Insurance Institute (CII) is a technical and supervisory qualification for insurance staff working across all sectors of the industry, and the logical progression from the CII Certificate in Insurance.

The Diploma in Insurance will provide you with a firm understanding of insurance fundamentals and will enable you to build towards advanced technical knowledge, thereby ensuring you have the means to function effectively in a challenging environment.

The Diploma in Insurance is appropriate for:

- Insurance technicians and those who aspire to be technicians.

- Supervisors, team leaders and those with long-term ambitions of assuming managerial responsibilities.

- Anyone wishing to hold a recognised, respected insurance qualification.

- Insurance staff employed in support functions wishing to develop their knowledge of the business.

- Those wanting to develop their knowledge and understanding as part of a progression towards completion of the Advanced Diploma in Insurance and Chartered status.

Entry requirements

None, but it is recommended that candidates hold the CII Certificate in Insurance or 5 GCSEs at grade C or above or equivalent.

Completion requirements

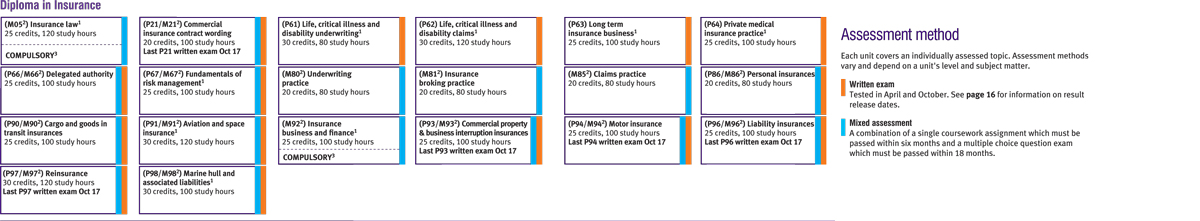

To complete the Diploma in Insurance you must obtain a minimum of 120 CII credits with at least 90 credits at Diploma level or above.

The following compulsory unit requirements apply:

- (M92) Insurance business and finance or (530) Economics and business (Advanced Diploma in Insurance unit); and

- (M05) Insurance law.

- We do recommend that all Diploma entrants also sit unit (IFI) Insurance, legal and regulatory, as this covers the workings of the market, including the legal and regulatory framework and the essentials of insurance practice.

The remaining credits can come from any of the units offered within the CII insurance qualifications framework enabling you to create a learning pathway suited to your job role for future aspirations.

Unit study materials for this qualification typically include:

- Study text with updates

- Continuous assessment programme

- RevisionMate online study support

- Revision courses

Completion entitles members to use the designation Dip CII or Dip CII (Claims) should you have passed (820) Advanced claims or (P85/M85) Claims practice. CII membership and Continuing Professional Development requirements apply.