Last year, Citywire published the Alpha Female – a special report on how far women have got in fund management and how they are performing.

Last year, Citywire published the Alpha Female – a special report on how far women have got in fund management and how they are performing.

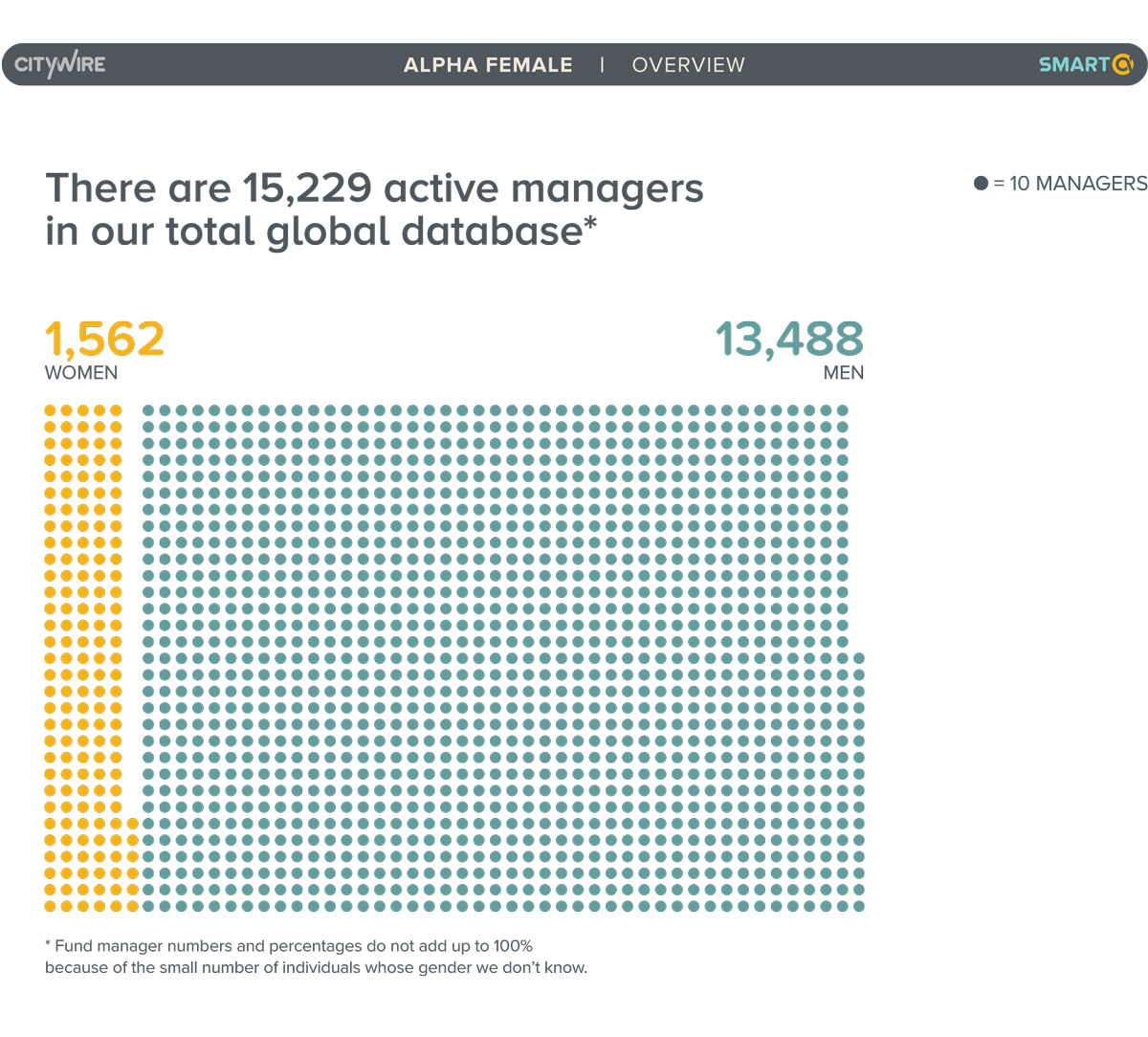

The report shows that women are under-represented in asset management: women make up only one in ten of the individuals employed to look after investors’ money and just 7% of the funds sold to the public around the world are run by a woman.

In the research, Katharine Dixon, Head of Fund Manager Research at Citywire, explains that: ‘The shortage of female fund managers means investors are missing out on the skills and the expertise that women can bring.’

Here are some of the highlights from the research:

- COUNTRY BREAKDOWN: With the world’s biggest stock market, the USA has more women fund managers than any other country: 618 or 39% of the global total. However, women represent just 7% of the 8,799 fund managers in America, a low proportion by international standards. Among countries with big investment markets, we see a clean sweep by European nations with Spain, France and Italy achieving the highest percentage of women fund managers to take the top three spots in our table.

Spain may be the spiritual home of the macho man but that has not prevented women securing 27%, or 188 of the 694 fund manager jobs in the country. The UK does comparatively poorly with 170 women fund managers accounting for just 9% of the total in the country.

source: https://citywire.co.uk/Publications/WEB_Resources/Creative/smart-alpha/alpha-female-may-2016.pdf

- BIGGEST FUNDS: Women typically run smaller funds than men. Funds managed solely by women have $315 million of assets on average against the $533 million average for a fund lifted by a solo male. That doesn’t mean there aren’t women holding up some very big funds though. There are 261 female fund managers with individual funds of over $1 billion assets. That rises to 338 women who hoist a total of over $1 billion in more than one fund.

- PERFORMANCE: Given the small numbers, it isn’t possible to make a judgement on the statistical significance, if any. But here are the raw numbers: of the 1,562 women fund managers in the database, 334 received a Citywire rating for good investment performance, based on their individual, three-year, risk-adjusted returns at the end of March. That’s just over 21%. The proportion of men with a Citywire rating was slightly higher: 3,180 of the 13,488 male fund managers we track achieved a performance rating at the end of March, or 23.5%. Similarly, 30 women achieved a top Citywire AAA rating. That’s 1.9% of 1,562 female fund managers. However, 321 men received an AAA rating, which is 2.4% of the 13,488 male managers we follow. If there were just seven more women fund managers with a Citywire AAA rating they would be neck and neck with the men.

source: https://citywire.co.uk/Publications/WEB_Resources/Creative/smart-alpha/alpha-female-may-2016.pdf

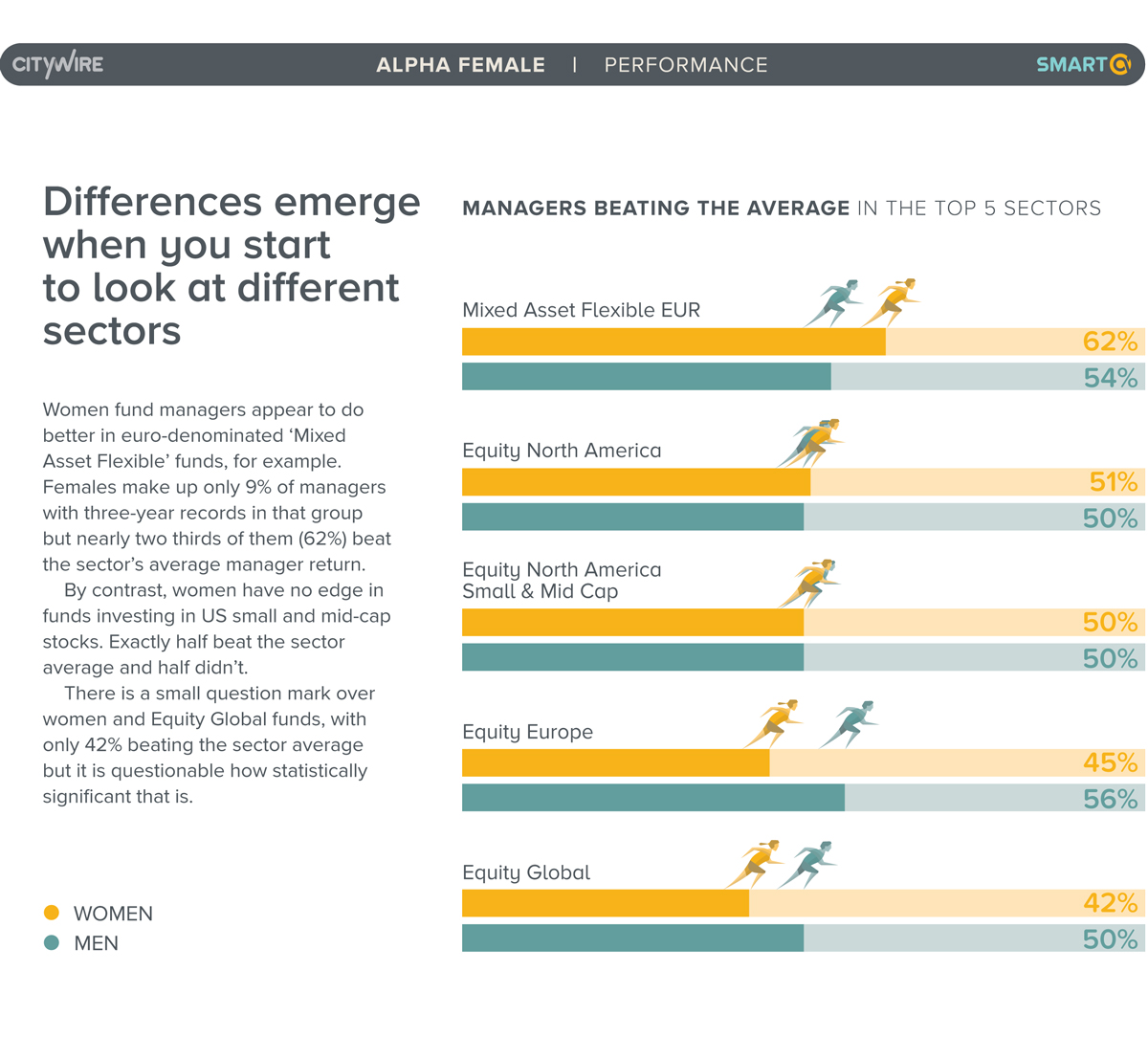

- SECTORS: Women fund managers appear to do better in euro-denominated ‘Mixed Asset Flexible’ funds. They make up only 9% of managers with three-year records in that group but nearly two-thirds of them (62%) beat the sector’s average manager return. By contrast, women have no edge in funds investing in US small and mid-cap stocks. Exactly half beat the sector average and half didn’t. There is a small question mark over women and Equity Global funds, with only 42% beating the sector average but it is questionable how statistically significant that is.

In this Citywire video, chief executives from some of the UK’s largest asset managers discuss the reasons for a ‘lad culture‘ that still exists, despite significant improvements and changes made in recent years.