People’s typical reactions when you speak about your career in Finance vary greatly depending on the area of finance you work in. Saying you work in almost any sub-section of finance gives a different impression: people would generally consider that: Traders love excitement; Investment Bankers are often master salesmen; High-frequency traders essentially applied mathematicians; Ops & Tech exactly like Ops and Tech anywhere else; that Legal & Compliance department to rival any small legal practice and lastly, non-banking finance departments more towards accounting than anything studies in business school. Mainly, let’s analyse the most common people reactions and their possible reasons:

People’s typical reactions when you speak about your career in Finance vary greatly depending on the area of finance you work in. Saying you work in almost any sub-section of finance gives a different impression: people would generally consider that: Traders love excitement; Investment Bankers are often master salesmen; High-frequency traders essentially applied mathematicians; Ops & Tech exactly like Ops and Tech anywhere else; that Legal & Compliance department to rival any small legal practice and lastly, non-banking finance departments more towards accounting than anything studies in business school. Mainly, let’s analyse the most common people reactions and their possible reasons:

- People with a career in Finance who work on Stock, Commodity or Foreign Currency Exchanges seem to get more attention as many people see these as more interesting careers, connected with power and therefore prestige. People think they understand the pressure that is on Traders, due in part to the way it is generally displayed on TV movies, with people in coloured jackets, waving their arms around. They can’t understand how more subtle than that is the real pressure, particularly now that the trading floor is largely computerised.

- Speaking about a career in the intermediate part of finance, i.e. day to day “retail” banking, here in the UK you generally get some mixed reaction, between someone to be looked up to and some kind of “back street salesmen”, which is, more or less, what banks have actually become over the last 25 years: glorified money shops to sell their “products”.

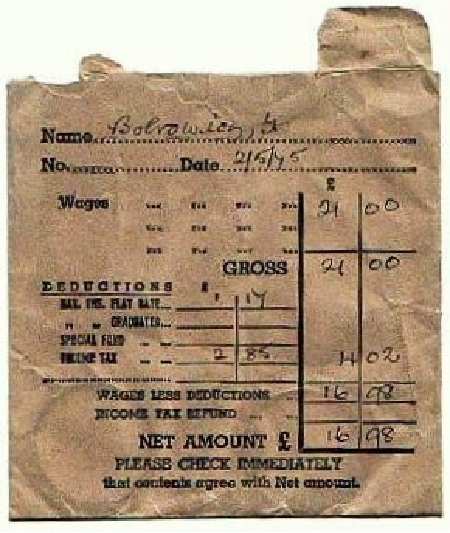

Unfortunately, in the end, when it comes to the part of finance that includes retail and commercial credit (borrowing), we must acknowledge that this kind of career in Finance has fallen into a bad reputation over the last 15 years, because of the mass lending and borrowing being encouraged to people who couldn’t afford the Finance. It was always seen to be a thing to be frowned upon, to borrow money from this level of operation. This feeling and kind of reaction dates back to the 1950s & 60s, when most borrowers didn’t have bank accounts and received their pay in cash on a Friday: that day happened most of the expenditure, including rent, the “house-keeping” budget to the wife for paying people like gas and electricity, buying the groceries. Many families got into financial difficulties: back at the time, there was a sensible company, called “Prudential”, and the ‘man from the Pru‘, as they were referred to” would come to collect the money on a Friday night. However, there was also a great number of the lowest level of very dangerous “back-street” lenders, which lent cash at an extortionate rate and would call at all sorts of times of the day to collect their instalments, many were at best aggressive, at worst violent. They are the reason why many people may be looked down upon if they mention that their career in Finance is for a lending company and they were later cleaned up by Government legislation with the advent of the Consumer Credit Act 1974 and the Banking Act 1991 (et. al.).

Unfortunately, in the end, when it comes to the part of finance that includes retail and commercial credit (borrowing), we must acknowledge that this kind of career in Finance has fallen into a bad reputation over the last 15 years, because of the mass lending and borrowing being encouraged to people who couldn’t afford the Finance. It was always seen to be a thing to be frowned upon, to borrow money from this level of operation. This feeling and kind of reaction dates back to the 1950s & 60s, when most borrowers didn’t have bank accounts and received their pay in cash on a Friday: that day happened most of the expenditure, including rent, the “house-keeping” budget to the wife for paying people like gas and electricity, buying the groceries. Many families got into financial difficulties: back at the time, there was a sensible company, called “Prudential”, and the ‘man from the Pru‘, as they were referred to” would come to collect the money on a Friday night. However, there was also a great number of the lowest level of very dangerous “back-street” lenders, which lent cash at an extortionate rate and would call at all sorts of times of the day to collect their instalments, many were at best aggressive, at worst violent. They are the reason why many people may be looked down upon if they mention that their career in Finance is for a lending company and they were later cleaned up by Government legislation with the advent of the Consumer Credit Act 1974 and the Banking Act 1991 (et. al.).

Whichever your career in Finance is, be prepared to be answered with some of these typical reactions, when you speak about your job, depending mainly on your luck on that day:

- “Should I invest in gold?”

- “I know a startup founder looking for money, can I hook you up?”

- “Ah, great, what stocks should I buy?”

- “Oh, actually do you mind if I ask you, what exactly, do finance people, you know, actually do?”

- “Isn’t that like gambling?”

- “I love men in suits”.