China’s Moody Outlook… China’s credit outlook was downgraded by rating agency Moody’s today The Risk On Rally Continues…, Risk on sentiment has been the tone driving the markets Could The Yens Safe Haven Status Push Above Further Stimulus…? Could U.S ISM Be The Deciding Factor? China Cuts Rates… Again: The 50bps cut has freed up an additional RMB 689 Billion of capital to be lent by Chinese banks. U.S GDP Smashes Estimates. Are We Back In Play…? Gross Domestic product printed a 1% annualised growth rate compared with the 0.4% expected…

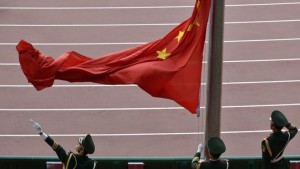

China’s Moody Outlook

China’s Moody Outlook

China’s credit outlook was downgraded by rating agency Moody’s today, from stable to negative amidst worries over the Chinese governments ability to manage its economic reform policies, rising debt and falling foriegn exchange reserves. China currently holds Aa3 rating with Moody’s, Double A minus and A plus with S&P and Fitch respectively. The news came after China reduced the amount of cash banks have to hold in reserve on Monday indicating that Communist party is prioritizing short-term stimulus over structural reforms . This downgrade comes as the markets are anticipating the NPC’s vote on the 13th five year plan, an economic development plan for the next five years.

It will be keenly scrutinized and will likely contain details of reforms and growth policy that China will pursue in coming years. Policy makers in China have been trying to ease China’s growth model away from heavy manufactoring and infrastucture projects into a consumption and services economy, but there are worries that this process with leave short term growth lagging. With China’s increasingly sluggish markets being a key cause of the jittery markets this year with growth figures from last year of only 6.9% down from 7.3% in 2014, the outlook downgrade is likely to put further downward pressure on the Yuan. Chinese officials however seem blase of the down grade stating that “western rating agencies” are typically bearish on emerging markets and on China in particular. Analysts state that the downgrade will have little appreciable effect on China.

![]() The Risk On Rally Continues

The Risk On Rally Continues

2.03.2016 Risk on sentiment has been the tone driving the markets over the last few weeks. Markets never move in a straight line and as humans we tend to all get caught up in what is happening now. The reality is that every bear market in history has had bullish moments, just like every bull market has had bearish moments. The guys that make all the money, are the ones who look ahead and ignore the noise. This bull run could just be noise. The data has improved; yes, and markets are smashing resistance levels left right and centre, but the rallies are by no means as strong as the drop off we saw in January. Alan Greenspan was on Bloomberg yesterday and came out with some interesting comments. He seems very bearish on not just the markets, but the overall global economic growth. He specifically discussed the Chinese slowdown, which seems to be at the backbone of everything going on currently. Ultimately, because the Chinese have the world’s largest population, they have the world’s greatest demand for many resources. This slowdown is dramatically affecting global demand and therefore pushing inflation into scarily low levels. For now the retracement still remains exactly that, a retracement. This retracement could go a lot higher though, so remain cautious of shorting too early.

![]() Could The Yens Safe Haven Status Push Above Further Stimulus…?

Could The Yens Safe Haven Status Push Above Further Stimulus…?

1.03.2016 A Senior economic advisor to Shinzo Abe, Japan’s Premier, has today suggested intervention in the Foreign Exchange markets to stop the high price of the Yen being exploited by speculators. This rise in the Yen against the Greenback (where it peaked around 111.00) and EUR has mostly been buoyed on by the recent sell off in the global equity markets and poor economic sentiment. The Yen is being seen as a safe haven for Forex traders. This could change however with the threat of government intervention which could soon reverse that trend, as the Nikkei is taking heavy hits from a strong Yen, with export companies dealing with mainland China bearing the brunt of market capitalization losses thanks to fears of further Yuan devaluation, by in large due to the recent RRR cuts.

This contingency is supported by Goldman Sachs who stated: “Fundamentally, we think this is about whether the BOJ is backing away from its 2 percent inflation target and we see no indication – whatsoever –that this is the case.” Goldman Sachs also cited an increase in capital outflows from Japan that may weaken the Yen further, mainly fueled by the Government Pension Investment Funds of Japan. However, alternatives to the Yen do seem few and far between with market volatility in the US due to the presidential race and underlying market sentiments, with traders paying close attention to employment figures over the coming week to allay fears over the possibilities of a recession. Meanwhile, the Euro continues to suffer acutely from Brexit fears and expectations of further ECB QE.

![]() Could U.S ISM Be The Deciding Factor?

Could U.S ISM Be The Deciding Factor?

1.03.2016 The big question right now, is whether or not we are seeing a retracement or a return to the bull market we’ve seen for the last 7 years. U.S ISM Manufacturing PMI could be a deciding factor in the way markets go for the next few weeks. Recently we’ve seen contraction in the U.S manufacturing sector. This in conjunction with the slowdown in Chinese Growth, has had a big impact on market sentiment over the last few months. However, recently we’ve had a bit more optimism come back into the markets, with global equities rising and dollar strength coming back into play. It’s almost a certainty that the Fed won’t raise rates now at the meeting this month. However, the ISM PMI to be released today could give us some insight into whether or not we could expect a hike at the next meeting.

Markets generally look forward several months at a time, and so will be pricing in any expectations for a future hike over the next few weeks. If we remain below 50, which is very likely, don’t expect too much action from the markets. If we drop to below 48 or move above 50, then volatility in stocks and the dollar should be extensive. Expect strength in U.S equities and the Greenback if we move into growth territory again. Moreover, if a return to growth is the outcome this afternoon, it will dramatically reduce the chances of a future recession in the U.S.

![]() China Cuts Rates… Again

China Cuts Rates… Again

29.02.2016 PBoC has slashed the amount of cash China’s Bank have to hold in reserve for the fifth time since last February, this move was intended to boost market confidence and revive its slowing economy. The 50bps cut has freed up an additional RMB 689 Billion of capital to be lent by Chinese banks, however there are fears that this move could cause further depreciation of CNY and CNH which will increase volatility in both foreign exchange and equities markets. A previous RRR cut in August 2015 had caused a drop in EUR/USD pair in the immediate aftermath whereas Deutsche Bank predicated that a RRR cut of 50bps last year would increase the strength of the AUD against the USD.

China’s recent RRR cut has however caused a 1% increase in the price of Gold which is up 10% thus far this month making seem a tempting safe haven for worried investors. The potential for depreciation comes against the back drop of a recent announcement from the G20 finance ministers and central bankers in Shanghai stating “If policy decisions lead to devaluation, we should inform and consult in advance between the different countries,” This policy was put in place in hopes of avoiding potential currency war where countries devalue their currencies in order to boost competitiveness. This news however could help Forex traders remain informed if information on countries intention to devalue there currency is published.

![]() U.S GDP Smashes Estimates. Are We Back In Play…?

U.S GDP Smashes Estimates. Are We Back In Play…?

29.02.2016 The US economy expanded in Q4 2015, giving USD bulls reason to be optimistic on the overall health of the economy. Gross Domestic product printed a 1% annualised growth rate compared with the 0.4% expected, sending the Dollar rallying as the Fed comes back into play for 2016. With further rate increases being all but written off after the horrible start to the calendar year, the GDP print removes the talk of recession and points to a continued rebound. The CNBC chart to the left shows the data from a visual viewpoint and while it is certainly contracting, it’s not as bad as what has been priced in. It’s this ‘not as bad as it could have been’ point that markets are lapping up at least for the short term. – Inventories +$81.7 billion annualised rate. – Growth -0.14% (-0.45% previous). – Trade gap -0.25% (-0.47%). – Household consumption +2% annualised rate (2.2% previous) – This is a huge part of the economy.

The summarised numbers above all point to the Fed being back in play this year. Each new piece of data causes the probability of a hike to swing wildly and it’s this perception that traders can take advantage of as Forex markets price and re-price one month to the next. The probability of a June hike rose to 35% from 24% last week, while a December hike jumped above the magic 50% level to 53% from 36% last week. Crazy.