The Corporate Finance professional qualification pathway of the Chartered Institute of Securities and Investment (CISI) from will provide you with specialist knowledge and expertise to foster a strong career in your chosen technical discipline whether it be securities, derivatives, financial derivatives, corporate finance transactions, financial markets, bonds and fixed interest markets or fund management.

In the Foundation Level of the Corporate Finance Qualification,

- The CISI Level 2 Award in Fundamentals of Financial Services is an important first step in developing the essential basic knowledge required for working in financial services. You will learn about the industry and commonly used financial products, such as shares, bonds and insurance and it will provide you with an understanding of financial terminology.

It is ideally suited to new or junior employees working in financial services. It is also appropriate for school leavers who are considering a career in finance. - The CISI Level 3 Award for Introduction to Investment offers a comprehensive introduction to the financial services industry, with a specific focus on investments. It is the foundation exam for many higher level CISI qualifications. The qualification covers key financial principles and products in depth including assets and markets, equities, bonds, derivatives and investment funds. It explores the broader economic environment in which the financial services industry operates and looks at how economic activity is determined and managed in different economic and political systems. The qualification offers the first introduction to financial services regulation and ensures candidates are provided with an understanding of ethical behaviour and acting with integrity. It is suitable for new entrants to the industry and staff who are beginning their career in financial services. The broad topics covered to make the qualification suitable for all staff, not just those responsible for making investment decisions, including administration, finance and accounting, IT, customer services, sales and marketing and HR and training. The International Introduction to Investment focuses on international markets.

In the Qualifying Level of the Corporate Finance Qualification,

CISI Capital Markets Programme offers a study pathway for practitioners in the capital markets wholesale sector. The programme offers flexibility as you can choose units of study covering Securities, Derivatives and Financial Derivatives. The programme was developed with representatives from leading global financial services organisations, both capital markets, wholesale and retail and with input from AFME, WMA, AIC, FOA and accredited training providers to meet the needs of the changing industry. The Capital Markets Programme is suitable for practitioners advising and/or dealing in securities and/or derivatives in the wholesale sector. The qualification is increasingly used as a benchmarking tool by major banks and investment firms to ensure that staff possess practical knowledge which can be immediately applied to business activities.

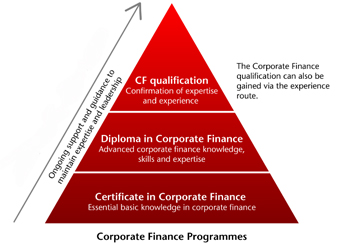

CISI Capital Markets Programme offers a study pathway for practitioners in the capital markets wholesale sector. The programme offers flexibility as you can choose units of study covering Securities, Derivatives and Financial Derivatives. The programme was developed with representatives from leading global financial services organisations, both capital markets, wholesale and retail and with input from AFME, WMA, AIC, FOA and accredited training providers to meet the needs of the changing industry. The Capital Markets Programme is suitable for practitioners advising and/or dealing in securities and/or derivatives in the wholesale sector. The qualification is increasingly used as a benchmarking tool by major banks and investment firms to ensure that staff possess practical knowledge which can be immediately applied to business activities.- The CISI Level 3 Certificate in Corporate Finance, in partnership with ICAEW, is part of the progressive study programme for the development and recognition of corporate finance expertise, to equip you with practical knowledge and skills, adding to your day to day business experience and enhancing the value you can bring to the organisations you work with. The programme starts with the CISI Certificate in Corporate Finance and is then followed by the CISI/ICAEW Diploma in Corporate Finance. Upon successful completion of both qualifications, practitioners can gain recognition of a full Corporate Finance qualification from ICAEW. The Certificate in Corporate Finance develops the essential foundation knowledge required to work in the corporate finance industry. The syllabus explores corporate finance legislation, regulation and techniques and provides you with an understanding of how corporate finance transactions are developed to meet client needs. It is suitable for practitioners working in corporate finance and related areas, such as venture capital, who need to demonstrate a sound understanding of both the regulatory and technical aspects of the subject. There are no entry requirements and the exam is open to all levels. (Resources for self-study: CISI Capital Markets Programme Certificate in Corporate Finance Unit 2 Syllabus Version 12: Review Exercises

)

- The CISI Level 4 Certificate in Investment Management has been designed to provide candidates with an advanced level of understanding of the key areas of investment management. It requires candidates to demonstrate their knowledge and understanding in a range of analytical scenarios. Suitable for a wide range of staff involved in managing investments; no previous qualifications are required. The level 4 Certificate in Investment Management consists of two units:

- UK Regulation & Professional Integrity will ensure that candidates can apply appropriate knowledge and understanding of UK financial markets, regulation and ethics to financial planning, advice and management for retail customers.

- Investment Management ensures that candidates have an understanding of investment management, the underpinning disciplines of economics, mathematics and accountancy as well as the tools of the trade – the different asset classes, the markets, investment analysis, portfolio management and performance measurement.

In the Professional Level of the Corporate Finance Qualification,

- The CISI Level 6 Diploma in Capital Markets is a leading professional finance qualification for practitioners working in wholesale securities markets. The qualification is the final step in the CISI’s capital markets study pathway and offers individuals the opportunity to gain specialist knowledge of financial markets, bonds and fixed income, financial derivatives and fund management. It is ideal for practitioners pursuing careers in treasury and financial controlling functions, private equity analysis, portfolio management, fixed income analysis, fund management, financial consulting, financial risk management, investor relations, internal audit and specialist financial operations. The practical techniques and skills developed through this qualification will enable successful candidates to demonstrate a very high level of competence to colleagues and clients and candidates will be well prepared to progress to more senior management positions. Resources for self-study:

The CISI Level 6 Diploma in Corporate Finance forms part of the jointly awarded programme by the CISI and ICAEW and will equip you with advanced corporate finance knowledge, skills and expertise. It will enhance the value you bring to the organisations you work with and help accelerate your career. The syllabus has been developed by corporate financiers to ensure it is work related and transaction-oriented. The Diploma assures a clear progressive path from the Certificate in Corporate Finance and successful completion may lead to full CISI Chartered Member status and the ICAEW Corporate Finance (CF) designatory letters. It is suitable for corporate finance staff seeking an advanced level qualification. It is particularly appropriate for holders of the CISI Certificate in Corporate Finance or ICAEW ACA qualification. Resources for self-study:

Check all the newest financial jobs >>