The Investment Operations Certificate IOC is the most established amongst the CISI Qualification options and is taken by practitioners globally to enhance their knowledge and skills of the administration and operations areas of the financial services industry.

The Investment Operations Certificate IOC is the most established amongst the CISI Qualification options and is taken by practitioners globally to enhance their knowledge and skills of the administration and operations areas of the financial services industry.

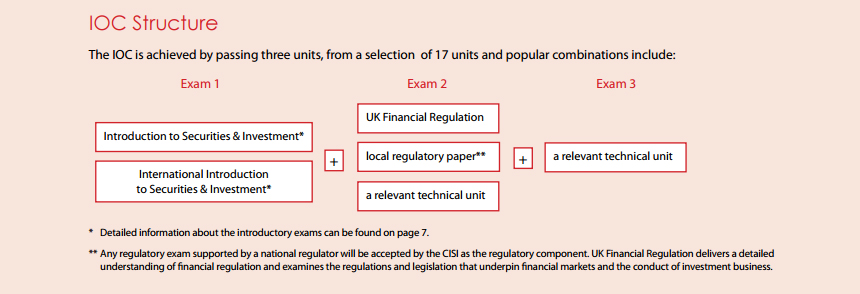

The qualification will provide you with an overview of the financial services industry and its regulation, whilst will also cover technical activities which are relevant to the area in which you work.

It is suitable for all professionals working in or aspiring to work in the administrations and operations areas of financial services.

80 -100 hours of study time per unit over a period of 3 – 4 months are recommended.

Each Investment Operations Certificate IOC unit is a one-hour, 50 multiple-choice question exam (with the exception of Global Financial Compliance and Risk in Financial Services which are two hours, 100 multiple-choice question exams, and Derivatives Operations which is a one hour thirty minute, 75 multiple-choice question exam). Exams are taken by CBT.

- Taken in over 50 countries, reflecting the global importance of operations

- Recognised by Ofqual, the office of qualifications and examinations regulation in England, as the level 3 Certificate in Investment Operations

- Recognised on the FCA’s Appropriate Qualification Tables as a suitable exam for overseeing roles

- Listed on the Financial Skills Partnership Qualifications List

- Recognised as the technical unit in the new level 3 Investment Operations Technician apprenticeship and can be taken as the technical unit in the new level 4 Investment Operations Specialist apprenticeship

- Recognised as a technical certificate of the Level 3 Providing Financial Services Advanced Apprenticeship

- ACSI designatory letters

CISI Investment Operations Certificate IOC Technical Units:

- Asset Servicing: Covers the fundamentals of asset servicing and aims to develop knowledge of capital instruments and transactions, the lifecycle of an event, mandatory and voluntary events, initial public offerings, proxy voting, aspects of tax, operational risk and controls, and legal and compliance issues.

- Client Money and Assets (CASS): This exam has been developed in response to requests from within the industry and to address the increased focus from the FCA on this area including the new rules which have been introduced. It will give those developing a career in this area the knowledge and expertise they need to excel in their role and progress in their career. IOC Client Money & Assets Books

>>

- Collective Investment Schemes Administration: Examines regulatory controls, constitution, roles and responsibilities and investment and borrowing powers. It also covers investment transactions and communications, registration and settlement, distribution of income and taxation.

- Combating Financial Crime: Financial crime spreads beyond individuals and firms, representing an issue of international significance in today’s globalised marketplace. Developed

with input from expert practitioners from global financial firms, including HSBC, PwC, Bond Associates and the Dubai Financial Services Authority, the unit focuses on combating

financial crime, but also addresses issues such as corruption and the financing of terrorism. - Derivatives Operations: Offers a basic introduction to Exchange-Traded and Over-the-Counter Derivatives administration.

- Global Financial Compliance: This unit, an introduction to international compliance, addresses a range of topics such as risk management, understanding the regulatory environment, ethics, corporate social responsibility and corporate governance.

- Global Securities Operations: An introduction to global securities operations by looking at securities, the main industry participants, settlement characteristics, other investor services and aspects of taxation and risk.

- IT in Investment Operations: Examines how the role of IT relates to investment operations and the subjects delivered include; IT in the securities industry, the regulatory framework for IT, managing business change and the role of IT in the front office and pre-settlement phase.

- Managing Cyber Security: This new unit has been developed to provide candidates with a basic knowledge of the threat of cybercrime. Candidates will be able to evaluate the risks to the financial services industry and develop effective security solutions to prevent, detect and mitigate cyber attacks.

- Operational Risk: Offers an introduction to operational risk as it relates to roles in operations or administration. Areas covered include basics of risk, the nature of operational risk, the causes, events and impact of operational risk, the operational risk cycle, the support and control functions, enterprise risk management (ERM) and achieving common standards and protection.

- Pensions Administration: Recent changes to pension regulation make a strong knowledge of the area more important than ev.er. The unit has been designed and developed by senior industry practitioners to ensure it equips individuals with the knowledge to work with pensions and related products

Check all the newest financial jobs >>