Designed in consultation with London Market Insurance practitioners, the Chartered Insurance Institute CII Level 3 Award in London Market Insurance provides an essential grounding for new entrants to the market or those who have dealings with it. The Chartered Insurance Institute CII Level 3 Award in London Market Insurance provides also a broad understanding of insurance process and practice across the London market as well as detailed understanding of technical topics.

Designed in consultation with London Market Insurance practitioners, the Chartered Insurance Institute CII Level 3 Award in London Market Insurance provides an essential grounding for new entrants to the market or those who have dealings with it. The Chartered Insurance Institute CII Level 3 Award in London Market Insurance provides also a broad understanding of insurance process and practice across the London market as well as detailed understanding of technical topics.

The Award is suitable for a range of professionals, including:

- Employees of London Market insurance companies and reinsurers;

- Employees of broking firms placing business in the London Market;

- Lloyd’s managing agents and Lloyd’s members’ agents;

- Coverholders anywhere in the world whose business is underwritten in London; and

- Professional service organisations such as lawyers, accountants, actuaries and loss adjusters.

There are no entry requirements for this qualification.

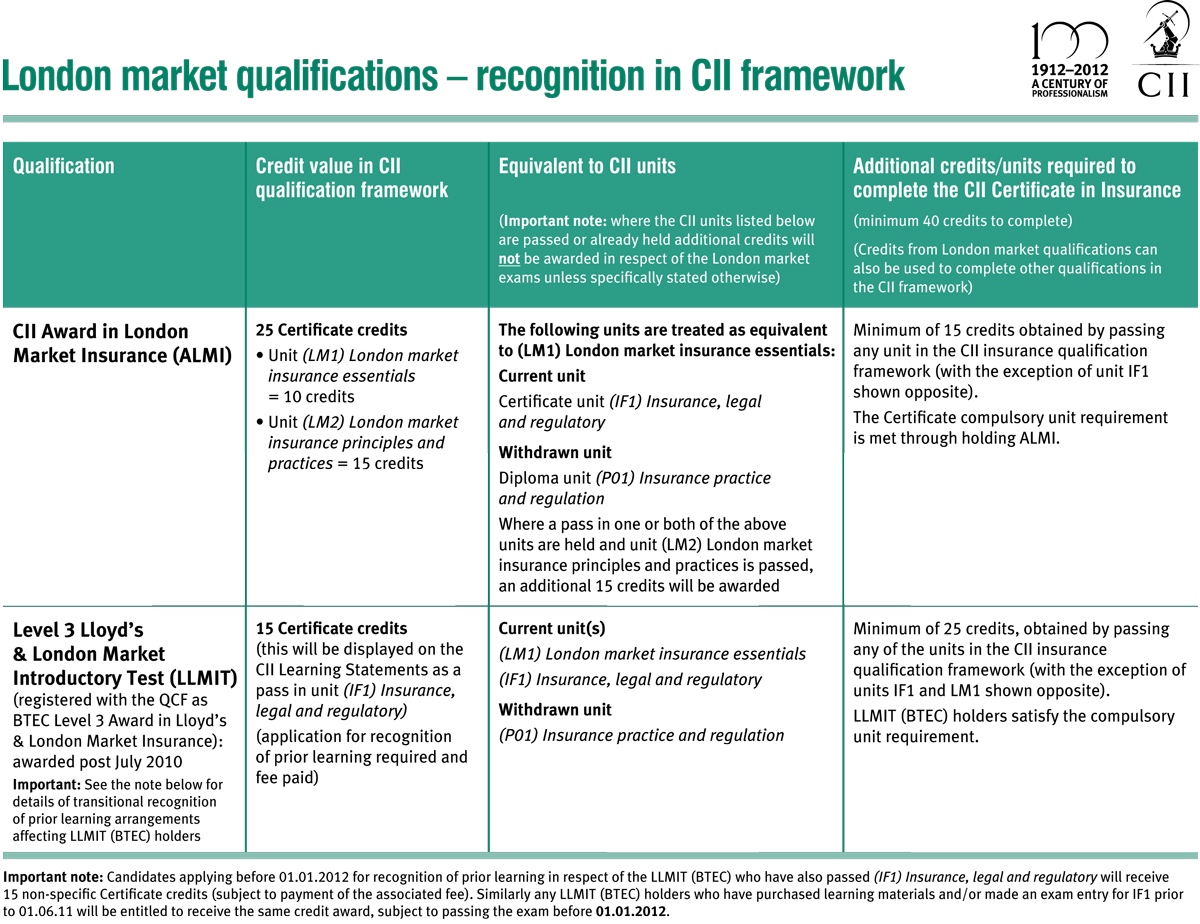

The Award comprises two compulsory units which provide a total of 25 credits upon successful completion:

- (LM1) London market insurance essentials; (10 credits) and

(LM2) London market insurance principles and practices (15 credits).

The notional Ofqual ‘Total Qualification Time’ for this qualification is 100 hours. This represents the time a student might typically take to complete the qualification.

Unit study materials for this qualification typically include:

- Study text with updates

- RevisionMate online study support

- Key fact booklet

- Question packs

- Learn interactive tutorial

- Revision courses.

Assessment format

Each unit is assessed by a single multiple-choice on-screen exam, tested year-round throughout the UK at a choice of over 40 centres. The qualification award will be graded fail/pass.

Chartered Insurance Institute CII qualifications involve the completion of one or more units, each covering an individually assessed topic. Assessment methods vary and depend on a unit’s level and subject matter. Assessment methods include:

- Multiple-choice exams – the assessment method for Award, Certificate, and Diploma in Regulated Financial Planning units R01-R05 assessed in the UK. Exams are delivered on-screen at a network of over 40 public centres across the UK. Sittings are available year-round, often on a weekly basis.

- Written exams – the assessment method for some Diploma and Advanced Diploma units and all units examined outside the UK. Sittings are typically available twice-yearly in April and October at over 50 public centres throughout the UK and over 120 public centres outside the UK.

- Coursework assessment – available for a select number of Advanced Diploma in Insurance units, Advanced Diploma in Financial Planning unit (AF6) Senior management and supervision and financial services unit (J09) Paraplanning, coursework assessment involves the completion of three written assignments during a 12 month period.

- Mixed assessment – available for a number of Diploma in Insurance units and all Diploma in Insurance units by April 2018 (unit codes begin with the letter M). This involves the successful completion of both a coursework assignment and a multiple-choice exam. This has an 18 month enrollment period.

- Dissertation assessment – available for Advanced Diploma units (991) London market insurance specialisation and (994) Insurance market specialisation. This involves the submission of a dissertation proposal and an 11,000-word dissertation. This has an 18 month enrollment period.

Read More