The Level 4 Diploma in Regulated Financial Planning by the Chartered Insurance Institute (CII) is the planning profession’s qualification of choice because it meets the FCA’s qualification requirements for retail investment advisers. This will enable you to meet the qualification requirements to practise in this area and expand your areas of expertise in your professional practice.

The Level 4 Diploma in Regulated Financial Planning by the Chartered Insurance Institute (CII) is the planning profession’s qualification of choice because it meets the FCA’s qualification requirements for retail investment advisers. This will enable you to meet the qualification requirements to practise in this area and expand your areas of expertise in your professional practice.

The Diploma in Regulated Financial Planning is a qualification that develops and assesses the FCA’s required technical knowledge and skills for advising on retail investments.

Who is the Diploma in Regulated Financial Planning for?

This qualification is particularly appropriate for:

- Anyone seeking to give retail investment advice, in particular, those who don’t hold additional CII credits counting towards completion of the Diploma in Financial Planning

- Paraplanners, technical consultants and those in financial planning support roles.

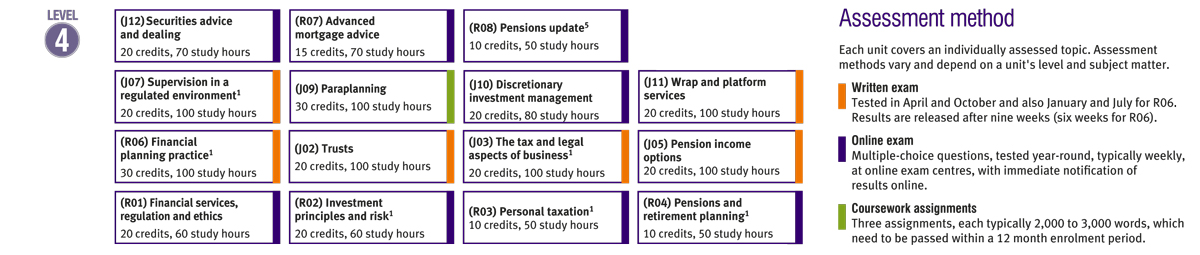

The CII Level 4 Diploma in Regulated Financial Planning meets the FCA’s qualification requirements for retail investment advisers and develops core technical knowledge and financial planning capabilities across six compulsory units.

Five of these units cover technical knowledge and application within the specific topic, nd the final unit covers the integrated practical application of these technical knowledge and planning skills.

- (R01) Financial services, regulation and ethics. Holders R01 are authorised to advise under supervision while they work towards the full Diploma.

- (R02) Investment principles and risk;

- (R03) Personal taxation;

- (R04) Pensions and retirement planning;

- (R05) Financial protection; and

- (R06) Financial planning practice.

The RQF Level 4 Diploma in Regulated Financial Planning in particularly suitable for:

- Anyone seeking to give retail investment advice, in particular, those who don’t hold additional credits from the Chartered Insurance Institute CII counting towards completion of the Diploma in Financial Planning

- Paraplanners, technical consultants and those in financial planning support roles

There are no entry requirements for this qualification and there are no additional completion requirements for this qualification.

Unit study materials for this qualification typically include:

- Study text with updates

- RevisionMate online study support

- Blended learning package

- Key fact booklets

- Question packs

- Audio revision

- Learn interactive tutorial

- Revision courses.

Units R01-R05, covering technical knowledge, are tested by multiple-choice on-screen exams.

Unit R06, which covers the practical application of technical knowledge and planning skills, is tested by a written case study-based exam.

Completion entitles PFS members to use the designation Dip PFS. Continuing professional development requirements apply.

Read the Diploma in Regulated Financial Planning specification »

Back to the Financial Training Companies and Course Providers that specialise in Qualifications to work in Finance and Investment Markets in the UK >