The Certificate in Mortgage Advice of the Chartered Insurance Institute CII is the benchmark qualification for mortgage advisers.

The Certificate in Mortgage Advice of the Chartered Insurance Institute CII is the benchmark qualification for mortgage advisers.

The RQF Level 3 Certificate in Mortgage Advice meets the FCA’s qualification requirements for mortgage advisers, and develops an understanding of the sector, the mortgage process and enables advisers to meet individual client needs.

This means that you will meet the qualification requirement to provide mortgage advice and be able to demonstrate to your employer and your customers that you have gained the required knowledge and skills to support their aims.

Who is this qualification for?

This qualification is particularly appropriate for:

- Anyone seeking to give mortgage advice.

- Anyone working a non-advisory role in the mortgage market, for example, technical consultants or those in support roles.

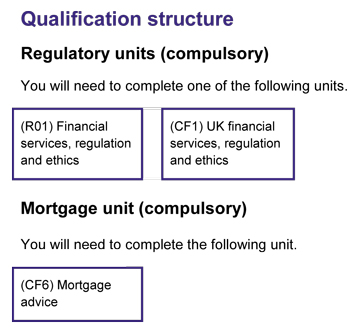

It involves completion of two compulsory units:

- (R01) Financial services, regulation and ethics; or

- (CF1) UK financial services, regulation and ethics; and

- (CF6) Mortgage advice.

The RQF Level 3 Certificate in Mortgage Advice is particularly suitable for:

- Anyone seeking to give mortgage advice

- Anyone working a non-advisory role in the mortgage market, for example, technical consultants or those in support roles

Entry requirements: None.

Entry requirements: None.

Unit study materials for this qualification include:

- Study text with updates

- RevisionMate online study support

- Blended learning package

- Key fact booklets

- Question packs

- Audio revision

The notional Ofqual ‘Total Qualification Time’ for this qualification is 160 hours. This represents the time a student might typically take to complete the qualification.

Each unit is assessed by a single multiple-choice on-screen exam, tested year-round throughout the UK at a choice of over 40 centres. The qualification award will be graded fail/pass.

Completion entitles members who are also members of the CII’s Society of Mortgage Professionals to use the designation Cert CII (MP). Continuing professional development requirements apply.

Read more:

Back to the Financial Training Companies and Course Providers that specialise in Qualifications to work in Finance and Investment Markets in the UK >