The Certificate in Financial Services has been developed by the Chartered Insurance Institute CII to meet the needs of those working in operational and technical support roles and offers two targeted learning routes.

The Certificate in Financial Services has been developed by the Chartered Insurance Institute CII to meet the needs of those working in operational and technical support roles and offers two targeted learning routes.

Certificate in Financial Services Qualification overview

The CII Level 3 Certificate in Financial Services provides fundamental knowledge and understanding of the financial services sector, including its customers, its products and practices and the regulatory and legislative environment.

It has been developed to meet the needs of those working in operational and technical support roles and offers two targeted learning routes.

Who is the Certificate in Financial Services for?

This qualification is particularly appropriate for:

- those working in the life, pensions and long-term savings sector, including customer operations back-office staff and contact centre team leaders (particularly the life and pensions route).

- those providing operational support to financial planners, including paraplanners, and technical support staff working in financial services (particularly the general route).

You will be able to use the qualification content to support and develop your understanding of your organisation’s practices and your role within these. It is also designed to support your career development by introducing the broad areas of the industry in which you may wish to specialise further.

Key progression routes include the Award in Financial Administration, the Certificate in Regulated Financial Services Operations or personalised technical professional development using specific units.

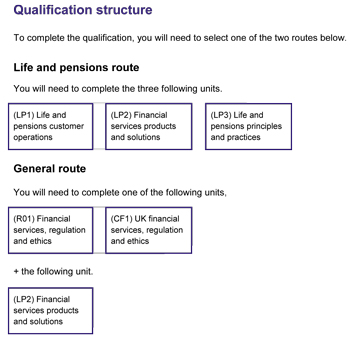

You will learn about the financial services sector and the customer needs and products within it by taking one of two routes:

Certificate in Financial Services Life and Pensions route:

This three-unit route of the RQF Level 3 Certificate in Financial Services is particularly suitable for those working in the life, pensions and long-term savings sector, including customer operations back-office staff and contact centre team leaders.

It develops knowledge and understanding the sector’s role and its activities; key customer needs, solutions and products; and how individuals and organisations work within a regulatory and legislative environment. The life and pensions route involves completion of three compulsory units:

- (LP1) Life and pensions customer operations;

- (LP2) Financial services products and solutions;

- (LP3) Life and pensions principles and practices.

Certificate in Financial Services General route:

This two-unit route of the RQF Level 3 Certificate in Financial Services, instead, is ideal for those providing operational support to financial planners, including paraplanners, and technical support staff working in financial services. It develops knowledge and understanding of the financial services industry in general, including regulation and legislation; and fundamental aspects of customer service, administration and marketing in financial services, and key retail investment products. The general route involves completion of two compulsory units:

- (R01) Financial services, regulation and ethics; or

- (CF1) UK financial services, regulation and ethics; and (LP2) Financial services products and solutions.

Certificate in Financial Services Entry requirements:

Certificate in Financial Services Entry requirements:

None.

Unit study materials for this qualification typically include:

- Study text with updates ( the first exam included for units LP1, LP2 and LP3)

- RevisionMate online study support

- Revision courses

Each unit is assessed by a single multiple-choice on-screen exam, tested year-round throughout the UK at a choice of over 40 centres. Find out more by selecting the completion requirements link to the right of this page.

Completion of the life and pensions route entitles members to use the designation Cert CII (Life and Pensions). Completion of the general route entitles members to use the designation Cert CII (FS). Continuing professional development requirements apply.

Read the Certificate in Financial Services specification here »

Back to the Financial Training Companies and Course Providers that specialise in Qualifications to work in Finance and Investment Markets in the UK >