The Advanced Diploma in Financial Planning by the Chartered Insurance Institute (CII) is your route to becoming a Chartered Financial Planner.

The Advanced Diploma in Financial Planning by the Chartered Insurance Institute (CII) is your route to becoming a Chartered Financial Planner.

The RQF Level 6 Advanced Diploma in Financial Planning builds on existing skills and knowledge, enabling advisers to develop specialist planning capabilities and offer a sophisticated and comprehensive approach to financial management.

The RQF Level 6 Advanced Diploma in Financial Planning gives holders clear differentiation from the main body of advisers, with completion leading to Chartered Financial Planner status (holders need to have 5 years’ industry experience, not necessarily post-qualification).

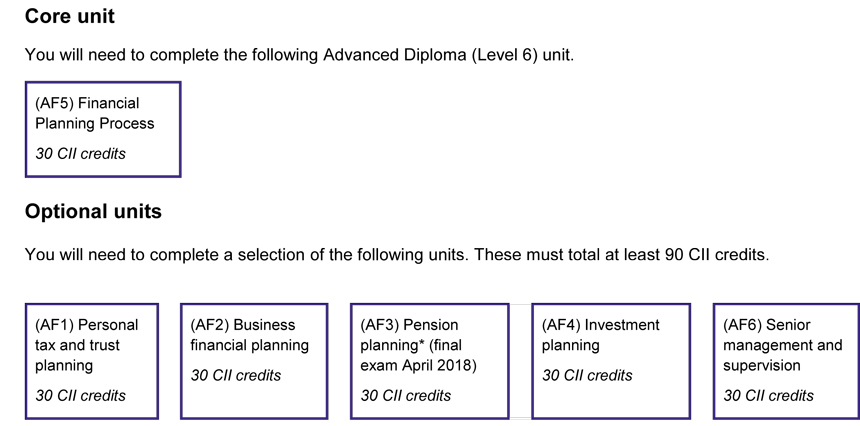

The Advanced Diploma in Financial Planning involves completion of:

- a selection of optional units, which each develop advanced skills in applying technical knowledge

to complex situations; and,

• a compulsory unit that assesses advanced planning skills.

Entry and professional completion requirements

Entry requirements

There are no entry requirements. However, to meet the demands of study at level 6 (approximately

Honours degree level), it is recommended that you complete the CII Level 4 Diploma in Financial

Planning or CII Level 4 Diploma in Regulated Financial Planning prior to studying CII level 6 units. You

will be required to hold one of these qualifications before you can complete the Advanced Diploma.

The Advanced Diploma in Financial Planning involves completion of at least four of the following eight financial planning units:

- (AF1) Personal tax and trust planning

- (AF2) Business financial planning

- (AF3) Pension planning

- (AF4) Investment planning

- (AF5) Financial planning process (compulsory)

- (AF6) Senior management and supervision

- (AF7) Pensions transfer

- (AF8) Retirement income planning (Find out more about enhancements being made to CII Level 6 pensions units)

Who is The Advanced Diploma in Financial Planning for:

- Retail investment advisers qualified at Level 4

- Paraplanners, technical consultants and staff in related support roles qualified at Level 4

Entry requirements

None, but one of the following CII qualifications must be held in order to complete:

Unit study materials for this qualification typically include:

- Case study workbook or study text

- RevisionMate online study support

- Audio revision

- Two-day revision workshops.

AF1-AF5 & AF7 are tested by case study-based written exams, held across the UK twice-yearly in April and October. AF6 & AF8 are assessed by three coursework assignments.

Completion entitles PFS members to use the designation APFS and the Chartered Financial Planner title for those with five years’ industry experience. Continuing professional development requirements apply.

Read the Advanced Diploma in Financial Planning specification »

Check all the newest financial advisor jobs >>