CISI Capital Markets Programme is a wide-ranging group of exams designed to meet the requirements of individuals working in the securities and derivatives markets within the UK and internationally.

CISI Capital Markets Programme is a wide-ranging group of exams designed to meet the requirements of individuals working in the securities and derivatives markets within the UK and internationally.

The CISI Capital Markets Programme offers you flexibility, as you can choose from a selection of units covering Securities, Derivatives and Financial Derivatives.

The CISI developed the CISI Capital Markets Programme with representatives from leading global financial services firms, both capital markets / wholesale and retail and with input from AFME, APCIMS, AIC, FOA and accredited training providers to meet the needs of the changing industry.

The CISI Capital Markets Programme is suitable for practitioners advising and/or dealing in securities and/or derivatives. No previous qualifications are required.

The CISI Capital Markets Programme is accredited by Ofqual as the level 3 Certificates in Investments. On the European Qualifications Framework, this equates to a level 4 qualification.

CISI Capital Markets Programme Key features

• Best-practice benchmark qualification for the capital markets/wholesale sector

• Specialist input from leading practitioners

• Globally portable, reflecting the needs of an international marketplace

• Streamlined syllabuses, focusing on key concepts and principles

• Student membership – become associated with a chartered professional body and take advantage of an extensive range of benefits

• ACSI designatory letters – upon successfully achieving the Capital Markets Programme you will be eligible for Associate membership of the Institute Securities Derivatives

Exam candidates in the UK, Ireland, Europe and North America taking any unit within the CISI Capital Markets Programme must have obtained a pass in IntegrityMatters as a pre-requisite to sitting the exam. IntegrityMatters is an online integrity test designed to highlight ethical dilemmas which you might face at work.

How is the CISI Capital Markets Programme structured?

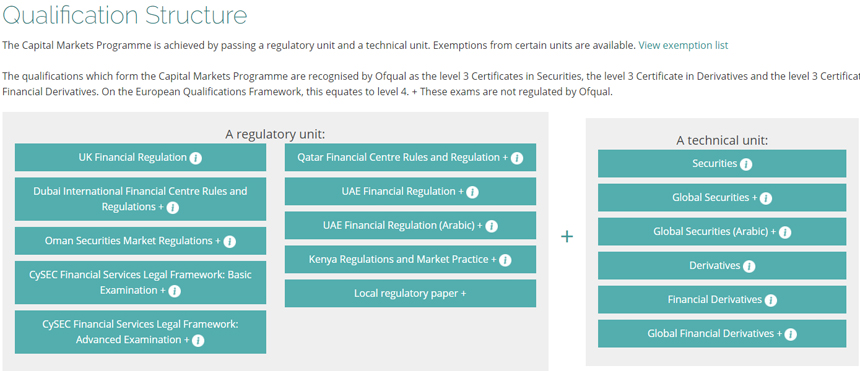

The CISI Capital Markets Programme comprises a modular exam structure of two units – a regulatory unit and a technical unit.

Regulatory unit (study time 100/80 hours)

UK Financial Regulation (self-study material: CISI Capital Markets Programme UK Financial Regulation Syllabus Version 24: Review Exercises

)

- Local regulatory unit for candidates regulated outside of the UK

Technical unit (study time 100 hours)

- Securities/Global Securities

Derivatives

- Financial Derivatives

Studying for the CISI Capital Markets Programme

The CISI’s learning manual policy requires, where available, the most up-to-date CISI learning manual to be purchased when booking an exam, including by an ATP on your behalf. This applies to all candidates sitting CISI exams in the UK (includes Northern Ireland, Guernsey, Jersey and Isle of Man). Candidates sitting CISI exams outside of the UK will receive

the most up-to-date learning manual for that subject in PDF format and this is included in the international exam price.

Candidates who are not currently CISI members will receive one year’s free CISI student membership and enjoy access to a number of benefits designed to offer learning support.

The regulatory unit is completed successfully by passing a one hour 30-minute multiple-choice question exam while technical units can be up to two-hour multiple-choice exams.

All exams can be taken at one of our Computer Based Testing (CBT) centres.

More books for Self-study for the CISI Capital Markets Programme

Check all The Chartered Institute of Securities and Investment CISI Qualification Pathways and the newest finance jobs.