The CFA Charter allows you to demonstrate your mastery of the investment analysis and decision-making skills most needed for a competitive career in the global investment management profession.

The Chartered Financial Analyst® (CFA) credential is the professional standard of choice for more than 31,000 investment firms worldwide. When hiring leading firms demand investment professionals with real-world analytical skills, technical competence, and the highest professional standards, often requiring the CFA credential for consideration.

Benefits of the CFA Charter

- REAL-WORLD EXPERTISE. Demonstrate your fluency with an advanced investment management and analysis curriculum that leverages current best practices and the experience of practitioners around the world to bridge real-world practices and theoretical knowledge.

- CAREER RECOGNITION. Stand out in the competitive global industry and gain instant credibility with peers, employers, and clients who know the hard work, intelligence, and profound commitment it takes to earn the charter.

- ETHICAL GROUNDING. Learn to apply ethical principles and gain a foundation in the skills needed to demonstrate a commitment to high standards of accountability and integrity that build a trusted reputation.

- GLOBAL COMMUNITY. Join a vast professional network of more than 135,000 charterholders worldwide and gain unmatched career resources, important relationships, and lifelong insights.

- EMPLOYER DEMAND. The top 11 global employers of charterholders include JPMorgan Chase, Bank of America, Merrill Lynch, UBS, RBC, HSBC, Wells Fargo, Credit Suisse, Morgan Stanley, Smith Barney, BlackRock, and Citigroup.

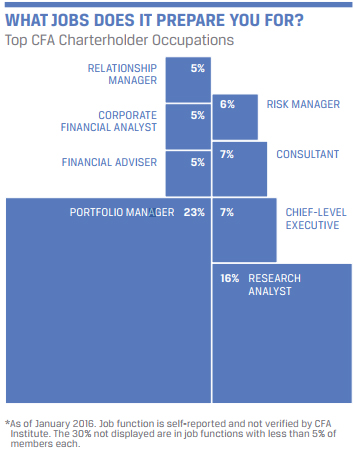

What jobs does it prepare you for? Top CFA Charterholder Occupations

What you will learn

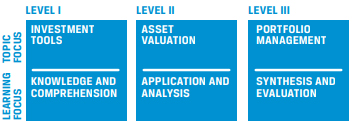

The CFA Program is offered in a self-study format and is divided into

three levels of exams.

The curriculum is organized into ten general topic areas that provide a framework for making investment decisions:

- ETHICAL AND PROFESSIONAL STANDARDS

- QUANTITATIVE METHODS

- ECONOMICS

- FINANCIAL REPORTING AND ANALYSIS

- CORPORATE FINANCE

- EQUITY INVESTMENTS

- FIXED-INCOME INVESTMENTS

- DERIVATIVES

- ALTERNATIVE INVESTMENTS

- PORTFOLIO MANAGEMENT AND WEALTH PLANNING

How to earn the CFA Charter

- Become a CFA candidate and enrol in the CFA Program. To do so, you must meet one of the following criteria:

- Have a bachelor’s (or equivalent) degree,

- Be in the final year of a bachelor’s degree program,

- Have four years of professional work experience, or

- Have a combination of professional work and university experience that totals at least four years.

- Be prepared to take the exams in English.

- Have a valid international passport.

- Meet the professional conduct admission criteria.

- Pass the Level I Exam (June or December).

- Pass the Level II Exam (June).

- Pass the Level III Exam (June).

- Have four years of professional work experience in the investment decision-making process (accrued before, during, or after participation in the CFA Program).

- Join CFA Institute as a regular member.

For more information, visit www.cfainstitute.org