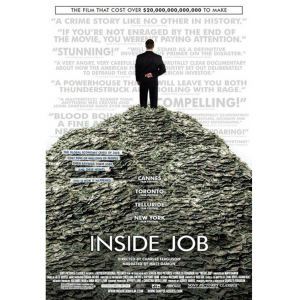

Charles Ferguson’s documentary Inside Job attempts to explain the complex set of financial arrangements which lead to the great global economic crash of 2008.

Charles Ferguson’s documentary Inside Job attempts to explain the complex set of financial arrangements which lead to the great global economic crash of 2008.

Fascinating interviews with numerous financial insiders offering different perspectives provides us with a clearer understanding of the financial meltdown. The film explores how changes in the policy environment and banking practices helped create the financial crisis, and how the consequences of the systemic corruption are seeping into almost everything.

Split into five parts, it takes you on a tour on the events which led to the global recession of the later 2000’s. Driven by Alan Greenspan, the 1980s saw liberalisation and deregulation of the markets and financial services. Banks and loan companies were freer to gamble with their depositors’ money; they were themselves freer to borrow more; they were free to offer investors complex financial products, and were allowed to sell (very) high-interest home loans to the insanely high-risk borrowers offering their traders mind-bowing bonuses to encourage such risk-taking.

Basically, a lot of home owners were given loans they could never repay. With this, there was a boom in the housing market, and because the ratio of money borrowed by banks versus the bank’s own assets reached to extraordinary heights, the banks ballooned to colossal sizes. However, it wasn’t long before the bubble burst with an almighty bang. The market collapsed, they run out of money, and they were left with hundreds of billions of dollars in loans they could not unload.

Basically, a lot of home owners were given loans they could never repay. With this, there was a boom in the housing market, and because the ratio of money borrowed by banks versus the bank’s own assets reached to extraordinary heights, the banks ballooned to colossal sizes. However, it wasn’t long before the bubble burst with an almighty bang. The market collapsed, they run out of money, and they were left with hundreds of billions of dollars in loans they could not unload.

Stock markets continued to fall, unemployment rose, and there were closures and bankrupt businesses happening daily, everywhere around the globe.

Top executives of the insolvent companies walked away with their personal fortunes intact. Ferguson suggests that the crash corrupted the discipline of economics itself. Distinguished economists from top Universities were drafted in by banks to compose reports supporting reckless deregulation and were subsequently paid a huge amount for these consultancies. This is what Ferguson means by the very title ‘Inside Job’.

There is a connection between the banks, the higher reaches of government, and the groves of academe. Bank CEOs become government officials, creating laws and policies only convenient for the likes of themselves, and destroying the likes of everyone else. It’s a cruel cycle.

The American financial industry promoted something they knew would fail resulting in investor losses showing that they deliberately set out to defraud the ordinary American investor.

The future? Only a new political mood for regulation will do, and this still seems far away.

The film has been created brilliantly, turning a sad tale into a drama, while reminding you that the horror is indeed on your doorstep. The effective presence of Narrator Matt Damon grips you into wanting to find out more.

The film has been created brilliantly, turning a sad tale into a drama, while reminding you that the horror is indeed on your doorstep. The effective presence of Narrator Matt Damon grips you into wanting to find out more.

A complex story told exceedingly well, and keeps you right on the edge of your seat, like any good thriller should do. Except, this thriller is really a reality show in which we are living right now.

I can’t help feel that this film has been shown a few years too early as the consequences are still very much, raw and tender. There’s certainly no fairy tale ending. Normally, a cinema trip feels you with feelings of amazement, escapism, and wonder, but this film makes it quite apparent that the film you are watching is your reality; there is no escape from this capitalist world that we are currently part of.