Findings from the EY Fintech Adoption Index 2017 indicate that, from being fintech products a niche competitor to a subset of the banking industry, digital consumers are being always more and more aware of the alternative banking solutions and now one-third of digitally active consumers use two or more fintech services.

Findings from the EY Fintech Adoption Index 2017 indicate that, from being fintech products a niche competitor to a subset of the banking industry, digital consumers are being always more and more aware of the alternative banking solutions and now one-third of digitally active consumers use two or more fintech services.

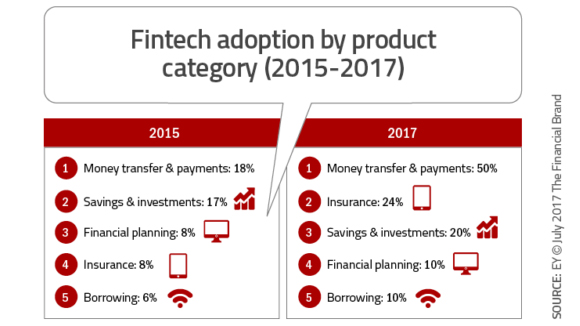

Over the past two years, the average percentage of digitally active consumers using fintech services in 2017 reached 33% across the markets evaluated. At the same time awareness of fintech services reached 84% in 2017, compared to only 62% in 2015.

The expectations of an even greater use of digital technologies have fueled the growth of fin-tech startups, remaining independent or partnering with legacy banking organizations or large tech companies,

Some of the primary strategies used by fin-tech firms have been:

- Offering a service for free or at a much lower cost than it traditionally had

- Solve a problem an existing customer base

- Provide an entirely new service

- Create word-of-mouth advocates

- Build a strong brand identity

- Leverage highly targeted marketing

Nowadays the solutions provided by many of the new financial services startups are meeting the needs of an increasingly digital consumer and the fin-tech firms are differentiating the customer banking experience.

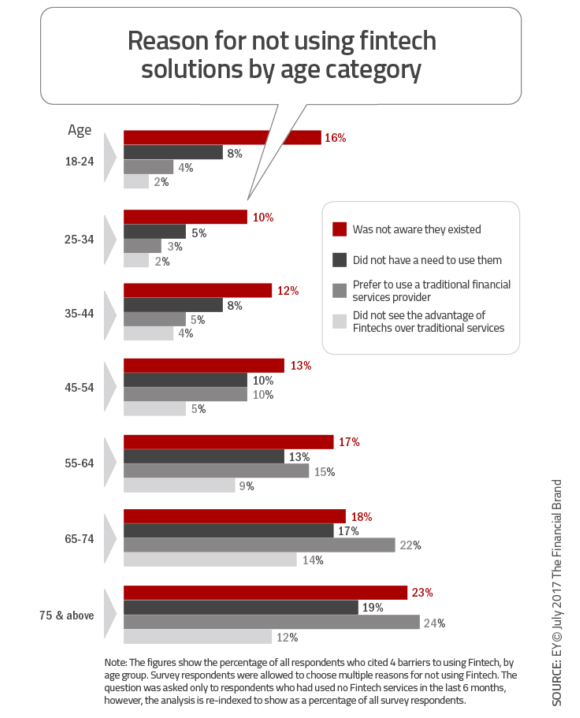

The age categories that were the most likely to be attracted to fin-tech solutions are correlated with those most likely to use digital devices (aged 25-44): this is also the demographic category of heavier financial product users, homeowners and more educated consumers. Fortunate for fin-tech providers, these consumers are also the most likely to try a new provider. Consumers in older age groups are more settled in their financial habits and more loyal to their current provider (less likely to switch).

According to EY, 64% of FinTech users prefer managing their lives through digital channels, compared to 38% of non-FinTech users, being also users of non-fintech digital platforms, such as on-demand services (digital taxis, online food, etc.) and the sharing economy (bike and housing rentals).

The emergence of open Application Programming Interfaces (APIs), Artificial Intelligence (AI), the Internet of Things (IoT) is creating the foundation for a new phase of growth and we will soon see if a whole new standard of consumer and banking expectations will be set.