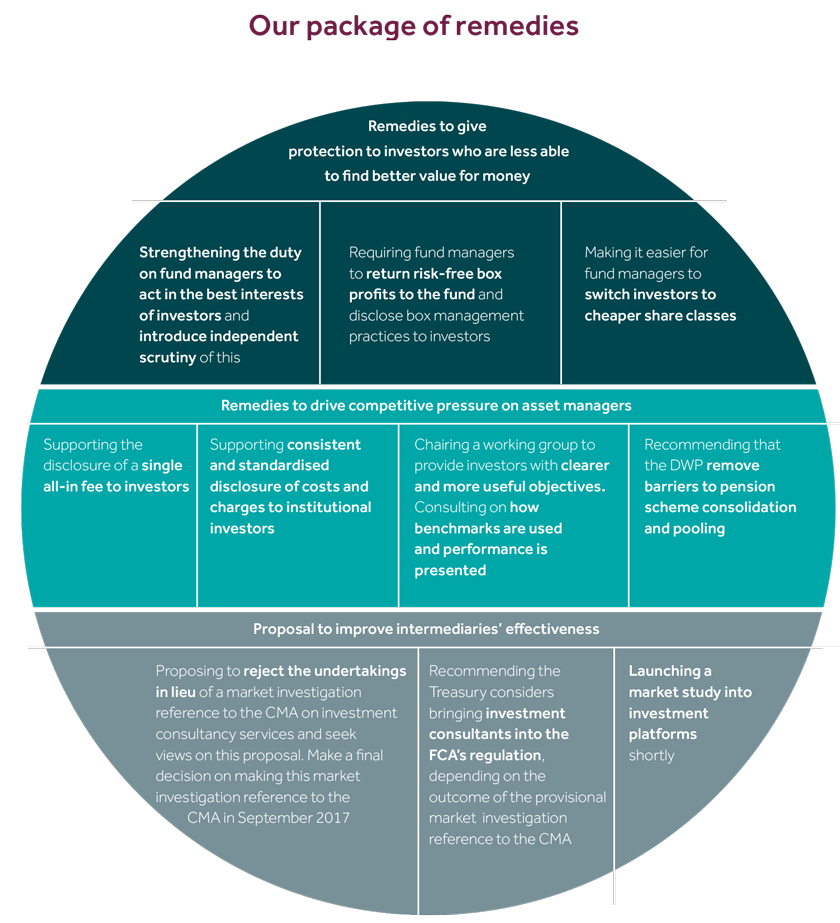

The Financial Conduct Authority (FCA)’s recently published the results of its Asset Management Market Study and announced the package of remedies it will take forward to address the concerns identified in its interim report into the sector.

The Financial Conduct Authority (FCA)’s recently published the results of its Asset Management Market Study and announced the package of remedies it will take forward to address the concerns identified in its interim report into the sector.

Andrew Bailey, Chief Executive at the FCA said:

“The asset management sector is important to the economy, managing the savings of millions of people and in the current low-

interest environment, it’s vital we help people earn a return on their savings.We need a competitive sector, attracting investment into the United Kingdom which also works well for the people who rely on it for their financial well-being. We have listened carefully to the feedback we received in response to our report last November. We have put together a comprehensive package of reforms that will make competition work better and help both retail and institutional investors to make their money work well for them.”

The Financial Conduct Authority (FCA)’s Asset Management Market Study final report confirms the findings set out in the interim report published last year, like, for example, that price competition is weak in a number of areas of the industry. Despite a large number of firms operating in the market, the FCA’s analysis found evidence of sustained, high profits over a number of years and recommended bringing investment consultancy services under its watch, too.

At this moment, the Financial Conduct Authority (FCA) does not regulate the advice provided by investment consultants and employee benefits consultants yet.

Integration between advisory and fiduciary services, though, was identified by respondents to the Financial Conduct Authority (FCA)’s report as the most serious potential conflict of interest.

Odi Lahav, CEO of Allenbridge, part of independent asset management consultancy MJ Hudson, said:

It’s encouraging that the Financial Conduct Authority (FCA) has considered some of these regulations and intends to pursue a course of action that will be aligned and complement those. Nonetheless, the Financial Conduct Authority (FCA) will need to take great care to ensure that it doesn’t damage the UK’s asset management industry.’ Fiduciary management is not a bad thing, per se, in fact it is a very sensible option for some clients, and it has helped to drive down fees. That said, our research has shown that the conflicts of interest can be significant, highlighted by the sales practices of some investment consulting firms, which one could argue is an abuse of their roles as trusted advisers. An investment consultant recommending themselves as the best fiduciary manager (ie asset manager), should not be allowed. If your investment consultant becomes your asset manager, then you need to hire a new consultant to advise you going forward.

Sally Bridgeland, investments chair at the Local Pensions Partnership, actuary and former CEO of the BP Pension Fund commented: ‘Increased professionalism of the consulting and asset management industry is important and regulation of investment consultants may help catalyse more professional behaviour, transparency and disclosure of conflicts. Although the costs are undesirable, many trustees may be more confident in extending the delegations to third parties if they are regulated.