Factory robots and self-driving cars are going to change the workforce, potentially eliminating millions of jobs.

Factory robots and self-driving cars are going to change the workforce, potentially eliminating millions of jobs.

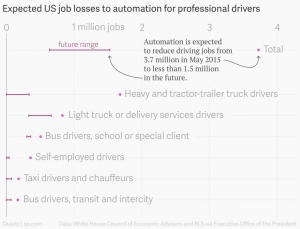

In a report published at the end of last year, the White House estimated that nearly 3.1 million drivers working today could have their jobs automated by autonomous vehicles:e.g., heavy trucking will see 80% to 100% of nearly 1.7 million drivers’ jobs automated. The White House predicts delivery drivers and self-employed drivers for on-demand services like Uber will face almost total automation as well.

But artificial intelligence can handle knowledge-based activities also quite good and it is becoming increasingly competent in white-collar work.

WHAT HAPPENED. Fukoku Mutual Life Insurance Co., a Japanese insurance company, is planning to introduce IBM Watson cognitive computing technology, an artificial intelligence (AI) system in January 2017 to improve operating efficiency.

WHAT IT IS. IBM Watson Explorer is a “cognitive technology that can think like a human,” and “can analyse and interpret all of your data, including unstructured text, images, audio and video.”

WHAT IT IS. IBM Watson Explorer is a “cognitive technology that can think like a human,” and “can analyse and interpret all of your data, including unstructured text, images, audio and video.”

TASKS. According to a company’s press release, the AI system based on IBM Japan Ltd.’s Watson will be tasked with reading medical certificates written by doctors and other documents to collect information necessary to determine insurance payouts, such as patient medical histories, injuries, the length of hospital stays, and administered surgical procedure names.

Furthermore, the software will take the customer’s words, convert them to text, and analyses whether those words are positive or negative. Similar sentiment analysis software is also being used by a range of US companies for customer service and a large benefit of the software is understanding when customers get frustrated with automated systems. Invoca, the call intelligence company, announced in December 2016it is embedding IBM Watson cognitive computing technology into its Voice Marketing Cloud to help marketers analyse and act on voice data in real time, getting deep insights about callers and conversations, which they can use to enhance and personalise the customer experience.

COSTS. Fukoku Mutual Life Insurance Co. will spend $1.7 million (200 million yen) to install the AI system, and $128,000 per year for maintenance, according to Japan’s National Daily The Mainichi. The company will then save roughly $1.1 million per year on employee salaries by using the IBM software, meaning it hopes to see a return on the investment in less than two years.

Tokyo, Japan: Pedestrians cross at Shibuya Crossing, one of the busiest crosswalks in the world.

HUMAN COSTS. Fukoku Mutual has already begun staff reductions in preparation for the system’s installation: in total, 34 people are expected to be made redundant by the end of March 2017, primarily from a pool of 47 workers on about five-year contracts. The company is planning to let a number of the contracts run out their term and will not renew them or seek replacements.

EXPECTED BENEFITS. Watson AI is expected to improve productivity by 30%, Fukoku Mutual says. The company was encouraged by its use of similar IBM technology to analyse customer’s voices during complaints. Automation of these research and data gathering tasks, in fact, is supposed to be helping the remaining human workers process the final payout faster, the release says.

OTHER COMPANIES. The Mainichi reports that three other Japanese insurance companies are testing or implementing AI systems to automate work such as finding ideal plans for customers: Dai-ichi Life Insurance Co. is already using a Watson system to process payment assessments, but alongside human checks, and it appears there have been no major staff cuts or reshuffling at the firm due to the AI’s introduction. Japan Post Insurance Co. is also looking to install a Watson AI for the same duties and is set to start a trial run in March 2017. Meanwhile, Nippon Life Insurance Co. began to use an AI system to analyse the best coverage plans for individual customers, based on 40 million insurance contracts held by its various salespeople. The system’s results are then used as a reference by the sales offices.

NOT ONLY IN JAPAN. An Israeli insurance startup, Lemonade, has raised $33.1 million Series B funding and Lemonade CEO and Co-founder Daniel Schreiber recently asserted in a press release:

“We believe in replacing brokers and paperwork with bots and machine learning, and we now have the backing to unleash this formula across new products and geographies”.

Almost all jobs have major elements that—for the foreseeable future—won’t be possible for computers to handle. And yet, we have to admit that there are some knowledge-work jobs that will simply succumb to the rise of the robots.