The IMC Investment Management Certificate is the required qualification for several UK Wealth management entry level jobs.

The IMC Investment Management Certificate is the required qualification for several UK Wealth management entry level jobs.

The IMC Investment Management Certificate delivers the threshold knowledge required by investment professionals involved in portfolio management, research analysis, and other investment activities.

The IMC is developed, delivered and awarded by CFA Society United Kingdom – CFA UK

Why should I take the IMC Investment Management Certificate?

If you’d like to get into Wealth management entry level jobs then the IMC Investment Management Certificate is suitable for you. More than a half of the candidates sitting the IMC Investment Management Certificate exam are already actively involved in front office investment activities, including portfolio management, research, investment consulting, risk management and relationship management.

Most investment firms ask their employees to take the IMC Investment Management Certificate to demonstrate the competency of their front office staff to the regulator.

The IMC Investment Management Certificate is an FCA Appropriate Qualification for the activity of ‘managing investments’ and may be combined with CFA Level 1 to meet the exam standards required of Retail Investment Advisers.

IMC level 4 cost and information

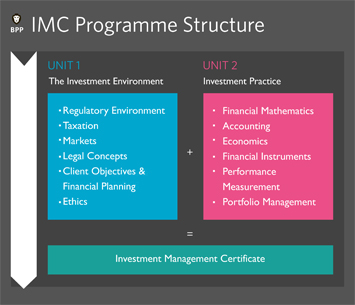

IMC syllabus

The IMC syllabus is developed by the IMC Panel with a wide range of practitioner input. It is refreshed and revised annually to reflect market and regulatory developments. The syllabus cycle runs from 1 December to the 30 November. For example, the version 14 syllabus is being tested from 1 December 2016 to 30 November 2017. Within the unit 1 exam, the tax rates tested for the version 14 syllabus are those for the 2016/17 Fiscal year which runs from 6 April 2016 to 5 April 2017.

Exam structure

The IMC is a level 4 examination, meaning it broadly equates to the difficulty level of the first year of an undergraduate degree. We estimate it will take an average candidate in the region of 200 hours to study for both units (unit 1: 80 hours/unit 2: 120 hours). The 200 hours includes attendance at any training courses you may be taking.

Question types

IMC syllabus is assessed by testing candidates on different question types. These include standard multiple choice questions, where the candidate selects one of four options; item set questions where candidates are given a short scenario with several questions associated with it; and gap fill questions where the candidate must enter a value into the answer field. There are specific formatting requirements and these formatting requirements are always given in the question.

Where online test delivery is used, it is standard practice for a small number of the test questions in an exam to be un-scored questions which do not contribute to the candidate’s end result. We use this approach in IMC exams. This is part of the process that enables us to ensure that the questions on which you are scored in your exam and which constitute your end result have gone through a robust review and validation.