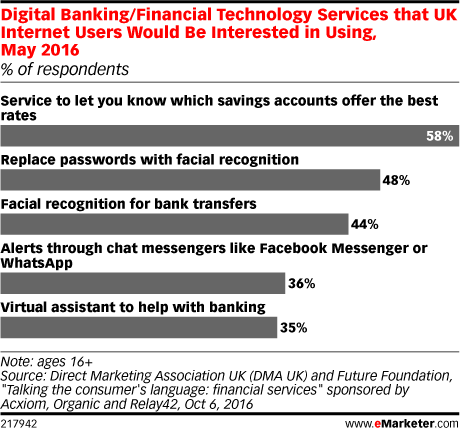

In May 2016 Direct Marketing Association UK conducted a survey which asked if UK internet users aged 16 and up would be interested in using a service which would let them know which saving accounts offer the best rates. Nearly 60% said they would be.

In May 2016 Direct Marketing Association UK conducted a survey which asked if UK internet users aged 16 and up would be interested in using a service which would let them know which saving accounts offer the best rates. Nearly 60% said they would be.

The survey also revealed that over 40% of respondents would like facial recognition to replace passwords when it comes to accessing their accounts and making bank transfers. Those UK internet users are concerned much more about security, rather than about privacy.

source: https://www.emarketer.com/Chart/Digital-BankingFinancial-Technology-Services-that-UK-Internet-Users-Would-Interested-Using-May-2016-of-respondents/199016

The results of the survey conducted in June by SAS and Future Foundation asking if UK millennial internet users feel comfortable sharing personal data with advertisers is that the standard of acceptability does vary depending on the situation. In fact, while many are uncomfortable sharing too much personal data, well over half of interviewed millennials named financial institutions as trustworthy destinations for their personal data.

In fact, according to a LexisNexis survey from May 2016, just 12% of internet users ages 18 to 34 in the UK don’t trust financial institutions to protect their personal information. In Germany, nearly 20% don’t trust financial institutions. In a time of general unease with regard to banks and the financial sector, young UK internet users are less than fearful of them, on the whole.

[Source]